According to our analysis USDJPY and EURUSD moved 44 pips on US Jobless Claims and US BLS Producer Price Index (PPI) data on 13 June 2024.

USDJPY (29 pips)

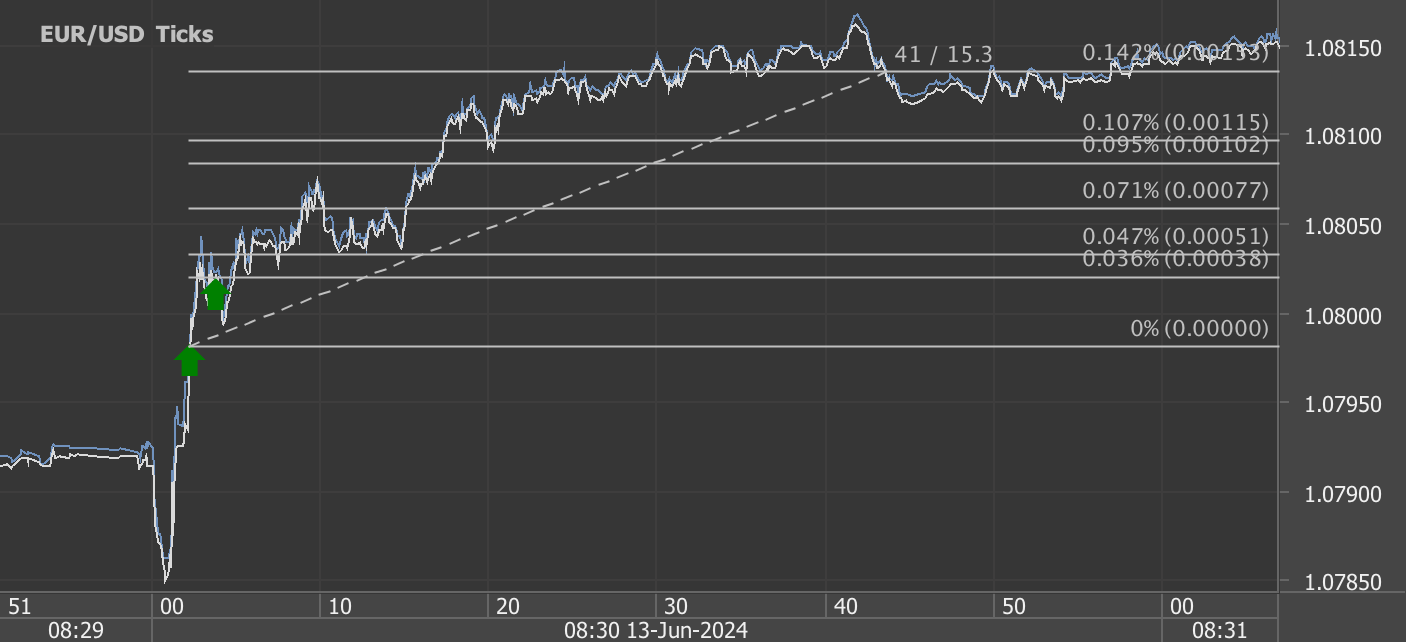

EURUSD (15 pips)

Charts are exported from JForex (Dukascopy).

Analyzing the Dip: A Closer Look at the May 2024 Producer Price Index Report

The U.S. Bureau of Labor Statistics' latest release of the Producer Price Index (PPI) for May 2024 presents some intriguing shifts in the economic landscape. The report, detailing the movements in prices from a producer's perspective, shows a decline in final demand by 0.2 percent. This is particularly notable following a 0.5 percent increase in April and a slight decrease in March. Over the past 12 months, however, the index for final demand has advanced 2.2 percent on an unadjusted basis.

Key Highlights from the May 2024 PPI Report

Decline in Final Demand Goods: The report indicates a significant 0.8 percent drop in final demand goods, marking the largest decline since October 2023. A major contributor to this decrease was the energy sector, which plummeted by 4.8 percent. This sharp decline in energy prices, particularly a 7.1-percent decrease in gasoline prices, heavily influenced the overall drop in goods prices.

Stability in Services: In contrast to goods, prices for final demand services remained unchanged in May, after a rise in the previous month. Within the services category, trade services and services excluding trade, transportation, and warehousing saw minor increases of 0.2 percent and 0.1 percent, respectively. However, transportation and warehousing services experienced a notable drop of 1.4 percent.

Intermediate Demand: Intermediate demand also saw significant shifts, with processed goods for intermediate demand falling by 1.5 percent, driven largely by an 8.0 percent decline in processed energy goods. On the other hand, unprocessed goods for intermediate demand declined by 1.8 percent, largely due to a 6.6 percent drop in unprocessed energy materials.

Economic Implications

The decline in the PPI for May underscores several key economic trends and potential implications:

Energy Sector Volatility: The substantial decrease in energy prices, especially gasoline and diesel, suggests volatility in the energy sector, which could be due to fluctuating global oil prices or changes in domestic production and inventory levels.

Inflationary Pressures: While final demand goods prices have fallen, the unchanged prices in services indicate sustained demand and potentially ongoing inflationary pressures in parts of the economy not directly impacted by energy costs.

Sector-Specific Impacts: The mixed performance across different sectors highlights the uneven recovery and challenges facing various industries. For example, while the food and alcohol retailing segments saw price increases, airline services and machinery and vehicle wholesaling faced declines.

Looking Ahead

As businesses and policymakers digest these figures, the PPI provides crucial insights into the pressures faced by producers which can eventually trickle down to consumer prices. The stability in services despite the drop in goods prices may cushion the overall economic impact in the short term. However, the ongoing volatility in energy prices remains a wild card that could influence future economic conditions.

In conclusion, the May PPI report serves as a vital barometer for economic health, offering a glimpse into the dynamics affecting producers that could shape policy decisions and market strategies in the coming months. With the next PPI release scheduled for July 12, 2024, all eyes will be on whether these trends continue, stabilize, or reverse, setting the stage for mid-year economic forecasts.

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feed for US economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.