The US Department of Labor (DOL) announced last week that they will terminate the dissemination of lockup data effective June 3rd. This is very good news because the change eliminates an “unfair competitive advantage for certain news organizations and their clients” (DOL Inspector General Report 17-14-001-03-315).

“Today I write to inform you that, effective June 3, 2020, the Department will permanently discontinue media lock-ups for all releases regardless of whether the current restrictions in place as a result of the COVID-19 pandemic remain necessary as of that date. BLS and DOL’s Employment and Training Administration (ETA) will continue to make their data available to the general public immediately upon their 8:30AM Eastern Time release through the Web and other sources.”

################################

Post from March 4th:

The US Department of Labor (DOL) announced this week on March 4th that they will terminate the dissemination of lockup data not before end of March 2020. At the moment it seems unlikely that BLS Employment Situation (Non-farm payrolls / NFP) will not be released from lockup on April 3rd. Therefor the change would need green light until March 20th. We will keep you posted.

“In my letter dated February 25, 2020, I announced that changes to the Department of Labor (DOL) press lock-up would be implemented no sooner than March 9, 2020. Over the past week, BLS and the DOL have engaged in highly informative and useful conversations with stakeholders. We continue to be committed to the secure, equitable, orderly, and timely dissemination of statistical data, as well as to addressing the Office of Inspector General’s findings and recommendations.

We have decided that the DOL, the press, and the public at large will be best served by delaying any changes to the lock-up policy beyond March 9, 2020. During this time, we will continue to hear from stakeholders while the DOL continues to work on the changes to the lock-up that enable us to best meet our goals of providing the public with equitable and timely access to data while ensuring the highest levels of security. Therefore, I am letting you know that we will not implement our new lock-up policy on March 9. We will give you, and the public at large, at least 14 calendar days’ notice before we implement any lock-up policy changes.”

################################

Post from March 2nd:

The US Department of Labor (DOL) will terminate the dissemination of lockup data in March 2020.

“A new policy is lock-up rooms will be free from all electronic devices.”

”At release times, BLS and ETA will continue to distribute official news releases through various dissemination methods, such as the DOL or BLS websites, Twitter feeds, and e-mail subscription lists.”

The following important economic releases will be affected by the change:

BLS Employment Situation (Non-farm payrolls / NFP)

BLS Consumer Price Index (CPI)

BLS Producer Price Index (PPI)

BLS Employment Cost Index (ECI)

According to the latest press release from February 25th, the implementation will not be finished before March 9th which means that BLS Employment Situation (NFP) will still be disseminated from lockup on March 6th. If there are no more changes to the implementation schedule, the first news release after the change would be BLS Consumer Price Index (CPI) on March 11th. You can find the full release calendar for March here.

Please feel free to sign up for a free trial of our low latency machine-readable news feed.

Sources: https://www.bls.gov/bls/changes-to-dol-media-lockup-effective-march-1-2020.htm , https://www.bls.gov/schedule/2020/03_sched.htm

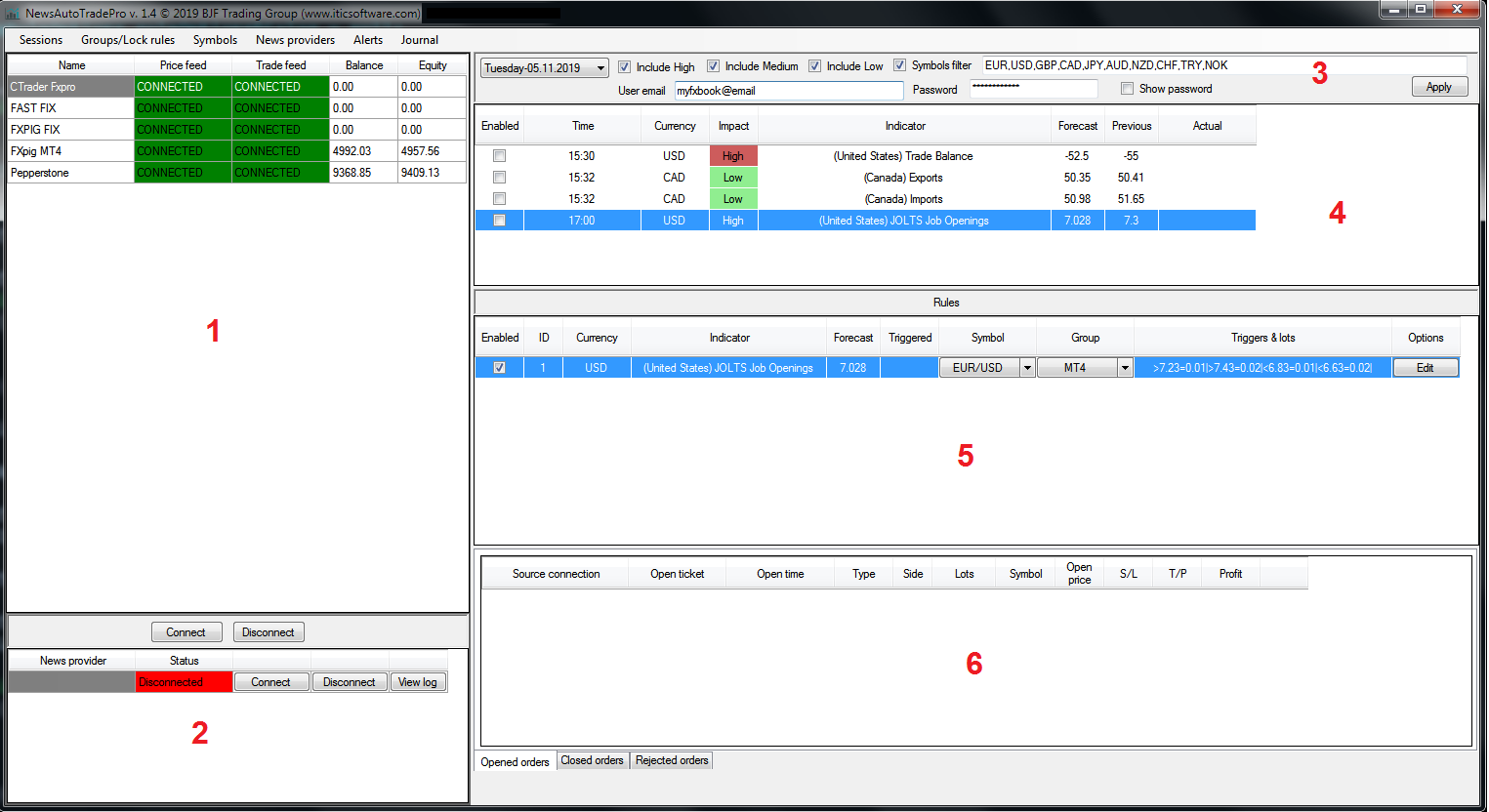

Start forex/oil/grains news trading with Haawks G4A low latency machine-readable data today, we offer the fastest machine-readable data feed for US economic and commodity data and economic data from Norway, Sweden, Russia, Turkey and ECB interest rates and statement.

Please let us know your feedback and check out our G4A low latency machine-readable data feed and the first G4A integrated trading application.

All data is machine-readable and available via API access in Aurora, CH1, NY4 and LD4. Free trials.