We are pleased to announce that there was a potential of 6044 pips/ticks profit out of the following 20 events in the third quarter of 2023 based on our ex-post analysis. The potential performance for 2022 was 9,269 pips/ticks.

Q3 2023

USDA WASDE (World Agricultural Supply and Demand Estimates) (188 ticks / 12 July 2023)

US Jobless Claims and US Producer Price Index (PPI) (54 pips / 13 July 2023)

Sweden Consumer Price Index (CPI) (101 pips / 14 July 2023)

University Michigan Consumer Sentiment / Inflations Expectations (56 pips / 14 July 2023)

US Durable Goods Orders and US Gross Domestic Product (GDP) (23 pips / 27 July 2023)

Sweden Gross Domestic Product (GDP), Retail Sales and Labour Force (271 pips / 28 July 2023)

DOE Petroleum Status Report (40 ticks / 2 August 2023)

US Jobless Claims and US Consumer Price Index (CPI) (39 pips / 10 August 2023)

University Michigan Consumer Sentiment / Inflations Expectations (43 pips / 11 August 2023)

USDA WASDE (World Agricultural Supply and Demand Estimates) (92 ticks / 11 August 2023)

DOE Petroleum Status Report (60 ticks / 23 August 2023)

Turkey Interest Rate Decision (4839 pips / 24 August 2023)

US Gross Domestic Product (GDP) (23 pips / 30 August 2023)

DOE Natural Gas Storage Report (28 ticks / 31 August 2023)

Canada Labour Force Survey (28 pips / 8 September 2023)

USDA WASDE (World Agricultural Supply and Demand Estimates) (44 ticks / 12 September 2023)

US BLS Consumer Price Index (CPI) (21 pips / 13 September 2023)

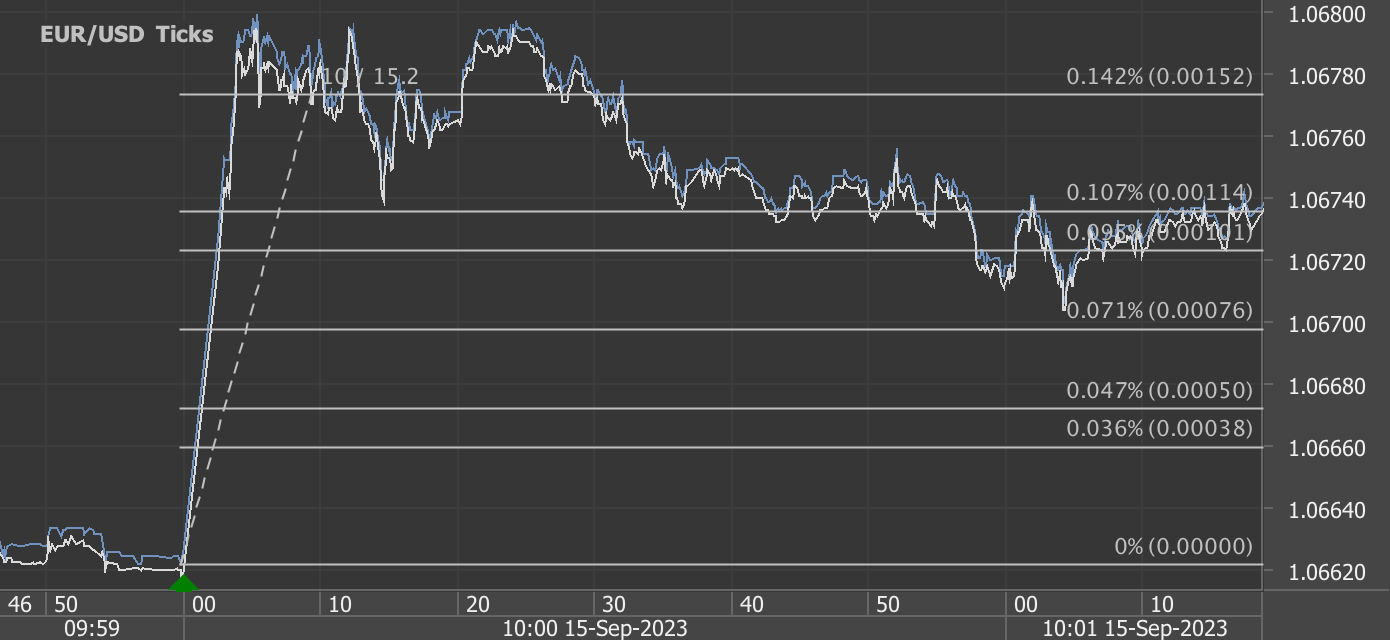

ECB interest rate decision (25 pips / 14 September 2023)

University Michigan Consumer Sentiment / Inflations Expectations (33 pips / 15 September 2023)

USDA Grain Stocks (36 ticks / 29 September 2023)

Total trading time would have been around 35 minutes in 3 months! (preparation time not included)

In Q3 2023, a series of significant economic events and reports had the potential to offer profitable trading opportunities in various financial markets:

USDA WASDE (World Agricultural Supply and Demand Estimates) - Released on 12 July 2023, this report impacted agricultural markets by providing supply and demand forecasts for key commodities. It led to a market reaction of 188 ticks.

US Jobless Claims and US Producer Price Index (PPI) - On 13 July 2023, these reports influenced perceptions of the US job market and inflation, affecting currency and commodity markets. This resulted in a market reaction of 54 pips.

Sweden Consumer Price Index (CPI) - Published on 14 July 2023, this report was essential for assessing inflation trends and influencing the Swedish Krona (SEK) exchange rate. It led to a market reaction of 101 pips.

University Michigan Consumer Sentiment / Inflation Expectations - Also released on 14 July 2023, these indicators reflected consumer confidence and economic outlook, impacting currency and equity markets. This resulted in a market reaction of 56 pips.

US Durable Goods Orders and US Gross Domestic Product (GDP) - On 27 July 2023, these reports provided insights into the US manufacturing sector and overall economic performance, influencing various financial instruments. The market reacted with a movement of 23 pips.

Sweden Gross Domestic Product (GDP), Retail Sales, and Labour Force - Published on 28 July 2023, these reports affected the Swedish economy and the SEK exchange rate, with GDP, retail sales, and labor force data being key indicators. They led to a market reaction of 271 pips.

DOE Petroleum Status Report - Released on 2 August 2023, this report influenced oil prices and related assets by revealing US petroleum inventories. It resulted in a market reaction of 40 ticks.

US Jobless Claims and US Consumer Price Index (CPI) - On 10 August 2023, these reports impacted US employment and inflation perceptions, influencing currency and commodity markets. This led to a market reaction of 39 pips.

University Michigan Consumer Sentiment / Inflation Expectations - Also released on 11 August 2023, these indicators offered insights into consumer behavior and inflation trends, affecting financial markets. The market reacted with a movement of 43 pips.

USDA WASDE (World Agricultural Supply and Demand Estimates) - On 11 August 2023, this report influenced commodity markets with forecasts for global agricultural supply and demand. It resulted in a market reaction of 92 ticks.

DOE Petroleum Status Report - Released on 23 August 2023, this report influenced oil markets by disclosing US petroleum inventory data. It led to a market reaction of 60 ticks.

Turkey Interest Rate Decision - On 24 August 2023, this decision from the Turkish central bank impacted the Turkish Lira (TRY) and related assets, resulting in a market reaction of 4839 pips.

US Gross Domestic Product (GDP) - Published on 30 August 2023, this report reflected the health of the US economy, influencing various financial instruments. The market reacted with a movement of 23 pips.

DOE Natural Gas Storage Report - Released on 31 August 2023, this report provided insights into US natural gas storage levels, affecting natural gas prices. It resulted in a market reaction of 28 ticks.

Canada Labour Force Survey - On 8 September 2023, this report offered data on Canadian employment trends, impacting the Canadian Dollar (CAD) and related assets. The market reacted with a movement of 28 pips.

USDA Grain Stocks - Released on 29 September 2023, this report provided information on grain inventories, influencing commodity prices and related assets. It resulted in a market reaction of 36 ticks.

These events and reports presented trading opportunities across various markets, allowing traders to make informed decisions and potentially profit from market movements during Q3 2023.

Start futures/forex/oil/grains news trading with Haawks G4A low latency machine-readable data today, we offer the fastest machine-readable data feed for US economic and commodity data and economic data from Norway, Sweden, Russia, Turkey and ECB interest rates and statement.

Please let us know your feedback and check out our G4A low latency data feed.

All data is machine readable and available via API access in Aurora, CH1, NY4 and LD4. Free trials.