We are pleased to announce that there was a potential of 2999 pips/ticks profit out of the following 30 events in the second quarter of 2022 based on our ex-post analysis. 2880 pips (96%) of the 2999 pips came from 26 DOE and USDA releases (87%). The potential performance for 2021 was 16,273 pips/ticks.

DOE Petroleum Status Report (41 ticks / 6 April 2022)

DOE Natural Gas Storage Report (66 ticks / 7 April 2022)

USDA WASDE (World Agricultural Supply and Demand Estimates) (96 ticks / 8 April 2022)

US Consumer Price Index (CPI) (19 pips / 12 April 2022)

DOE Petroleum Status Report (182 ticks / 13 April 2022)

DOE Natural Gas Storage Report (114 ticks / 14 April 2022)

DOE Petroleum Status Report (172 ticks / 20 April 2022)

DOE Natural Gas Storage Report (95 ticks / 21 April 2022)

DOE Petroleum Status Report (42 ticks / 27 April 2022)

DOE Petroleum Status Report (66 ticks / 4 May 2022)

DOE Natural Gas Storage Report (89 ticks / 5 May 2022)

US Consumer Price Index (CPI) (29 pips / 11 May 2022)

DOE Petroleum Status Report (72 ticks / 11 May 2022)

DOE Natural Gas Storage Report (128 ticks / 12 May 2022)

USDA WASDE (World Agricultural Supply and Demand Estimates) (136 ticks / 12 May 2022)

DOE Petroleum Status Report (51 ticks / 18 May 2022)

DOE Natural Gas Storage Report (13 ticks / 19 May 2022)

DOE Petroleum Status Report (53 ticks / 25 May 2022)

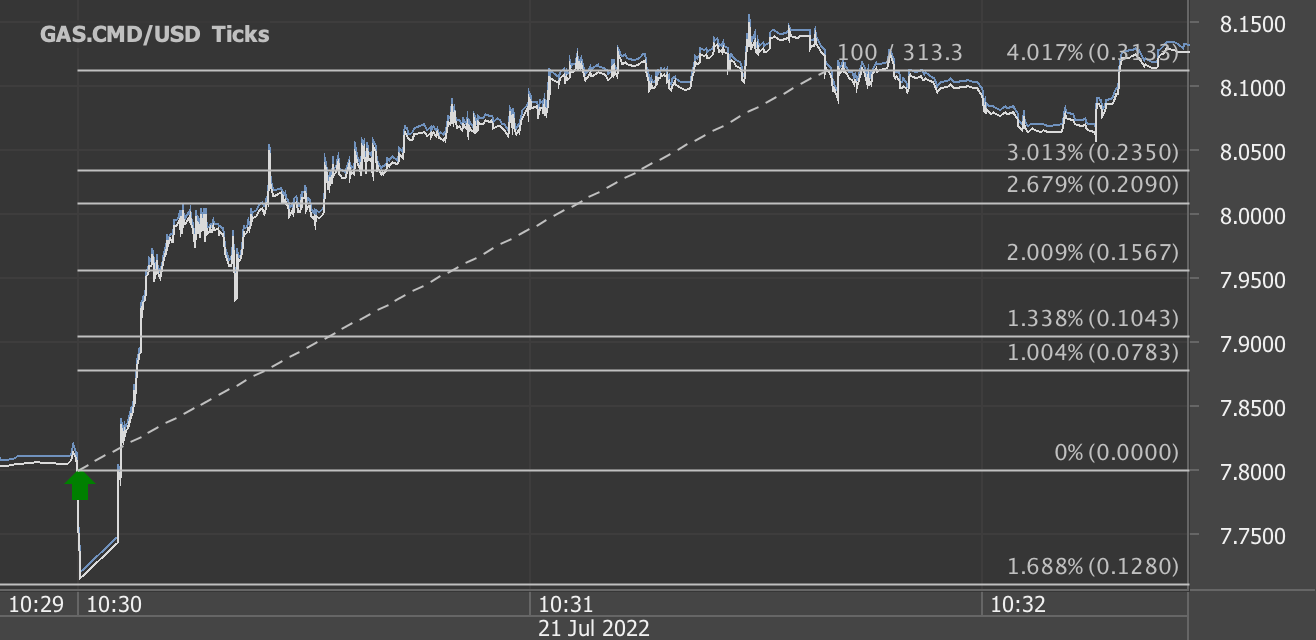

DOE Natural Gas Storage Report (245 ticks / 26 May 2022)

DOE Natural Gas Storage Report (193 ticks / 2 June 2022)

DOE Petroleum Status Report (148 ticks / 2 June 2022)

US Employment Situation (NFP / Non-farm payrolls) (28 pips / 3 June 2022)

DOE Petroleum Status Report (40 ticks / 8 June 2022)

DOE Natural Gas Storage Report (189 ticks / 9 June 2022)

US Consumer Price Index (CPI) (43 pips / 10 June 2022)

USDA WASDE (World Agricultural Supply and Demand Estimates) (108 ticks / 10 June 2022)

DOE Petroleum Status Report (38 ticks / 15 June 2022)

DOE Natural Gas Storage Report (53 ticks / 16 June 2022)

DOE Natural Gas Storage Report (167 ticks / 23 June 2022)

DOE Natural Gas Storage Report (283 ticks / 30 June 2022)

Total trading time would have been around 17 minutes in 3 months! (preparation time not included)

Start forex/oil/grains news trading with Haawks G4A low latency machine-readable data today, we offer the fastest machine-readable data feed for US economic and commodity data and economic data from Norway, Sweden, Russia, Turkey and ECB interest rates and statement.

Please let us know your feedback and check out our G4A low latency data feed.

All data is machine readable and available via API access in Aurora, CH1, NY4 and LD4. Free trials.