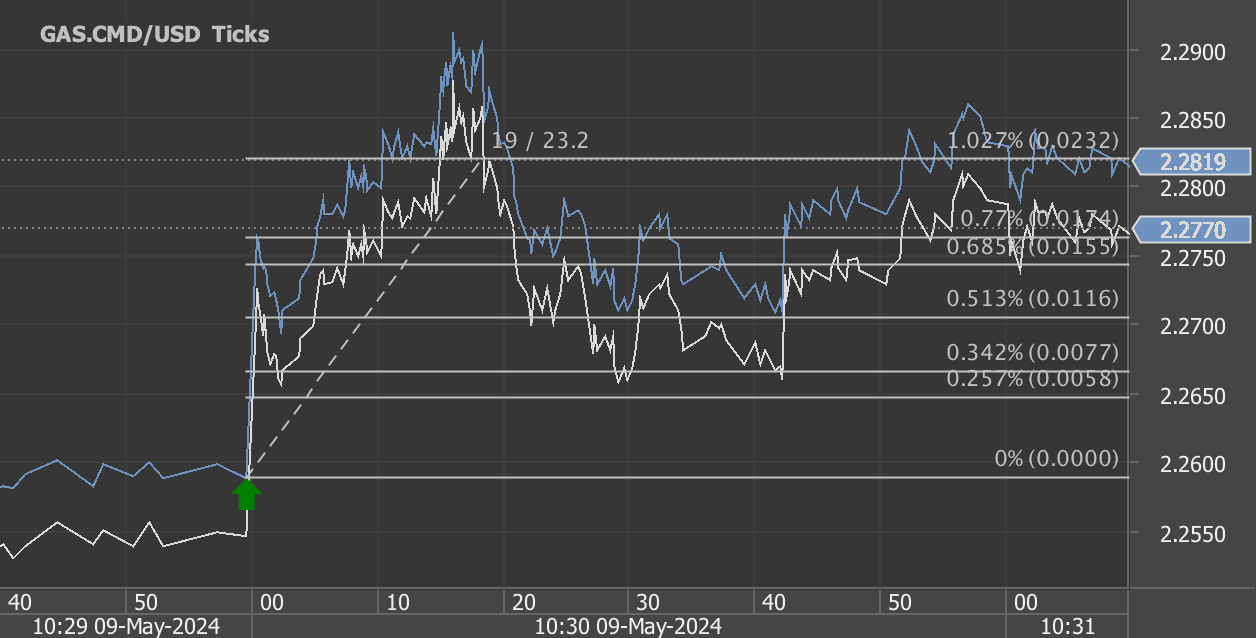

According to our analysis natural gas moved 35 ticks on DOE Natural Gas Storage Report data on 12 December 2024.

Natural gas (35 ticks)

Charts are exported from JForex (Dukascopy).

Weekly Natural Gas Storage Report Analysis for December 6, 2024

Released: December 12, 2024

Next Release: December 19, 2024

The Energy Information Administration (EIA) has released its latest Weekly Natural Gas Storage Report for the week ending December 6, 2024. This report provides valuable insights into natural gas inventories across the United States, helping analysts, traders, and policymakers understand supply and demand dynamics during the winter season.

Key Highlights

Total Working Gas in Storage: 3,747 billion cubic feet (Bcf)

Net Decrease: 190 Bcf from the previous week’s total of 3,937 Bcf

Year-Over-Year Comparison: 67 Bcf higher than the same period last year

Five-Year Average Comparison: 165 Bcf above the five-year average of 3,582 Bcf

At 3,747 Bcf, the current storage levels remain within the five-year historical range, indicating a relatively balanced inventory despite a notable weekly draw.

Summary of Regional Trends

East Region: The East saw a significant withdrawal of 58 Bcf, bringing current stocks to 856 Bcf. Compared to last year and the five-year average, this is a modest decrease of 0.7% and 0.3%, respectively.

Midwest Region: The Midwest experienced a 60 Bcf drawdown, reducing storage to 1,055 Bcf. Inventories are 0.8% lower than last year but still 1.9% above the five-year average.

Mountain Region: Despite a relatively small withdrawal of 7 Bcf, the Mountain region’s storage levels remain robust at 282 Bcf. This represents a 15.6% increase over last year and a 33% increase over the five-year average.

Pacific Region: The Pacific region saw an 8 Bcf draw, ending the week at 302 Bcf. Stocks are 4.5% higher than a year ago and 11.9% above the five-year average.

South Central Region: This region had the largest total withdrawal of 59 Bcf, bringing the total to 1,251 Bcf. Salt facilities contributed a 22 Bcf decline, while nonsalt facilities saw a 37 Bcf reduction. Despite the draw, stocks remain 2.4% higher than last year and 3.6% above the five-year average.

Key Insights and Market Implications

Seasonal Draws Begin to Ramp Up: With winter demand in full swing, withdrawals are accelerating. The total net decrease of 190 Bcf underscores the increased consumption driven by colder weather.

Healthy Inventories: Despite significant weekly draws, storage levels are still above both last year’s figures and the five-year average. This suggests a cushion against potential supply disruptions during peak winter demand.

Regional Variations: The Mountain and Pacific regions continue to show robust storage levels compared to historical averages, while the East and Midwest are experiencing tighter supplies.

Potential Market Impact: These storage dynamics can influence natural gas prices. Continued draws at this pace may push prices higher, particularly if cold weather persists.

Looking Ahead

The next report, scheduled for December 19, 2024, will provide further insights into how winter demand is impacting natural gas inventories. As we move deeper into the season, monitoring these weekly changes will be critical for assessing market stability and price trends.

Stay tuned for more updates and analysis!

Source: https://ir.eia.gov/ngs/ngs.html

Start futures forex fx commodity news trading with Haawks G4A low latency machine-readable data, one of the fastest data feeds for DOE data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.