According to our analysis corn (ZC) and wheat (WC) futures prices moved around 40 ticks (24 ticks and 16 ticks) on USDA WASDE (World Agricultural Supply and Demand Estimates) data on 11 February 2025.

WASDE February 2025: Market Insights for Agricultural Traders

The latest World Agricultural Supply and Demand Estimates (WASDE) report, released on February 11, 2025, provides key insights into global agricultural markets. With adjustments in supply, demand, and pricing across major commodities, traders should pay close attention to shifting trends in wheat, corn, rice, soybeans, and livestock.

Wheat Market: Lower Ending Stocks, Price Holds

The U.S. wheat outlook for 2024/25 reflects higher domestic use and lower ending stocks, which fell by 4 million bushels to 794 million. Despite this decline, stocks remain 14% above last year’s levels. The season-average farm price remains unchanged at $5.55 per bushel. Globally, wheat supplies increased slightly due to higher production in Kazakhstan and Argentina. However, world trade declined by 3.0 million tons due to reduced exports from the EU, Mexico, Russia, Turkey, and Ukraine. China’s wheat imports were significantly cut to 8.0 million tons—the lowest in five years.

Traders saw wheat futures decline by 16 ticks following the report, likely reflecting expectations of robust U.S. stocks and weaker global trade.

Corn Market: No Change in U.S. Outlook, Lower Global Production

The U.S. corn supply and use outlook remained unchanged this month, but the projected season-average farm price was raised by 10 cents to $4.35 per bushel. Globally, coarse grain production was forecasted 1.8 million tons lower, mainly due to yield losses in Argentina and Brazil caused by heat and dryness. With reduced production and smaller exports from Brazil, Ukraine, and South Africa, corn imports for China were also cut. Global ending stocks dropped to 290.3 million tons, a decrease of 3.0 million.

Corn futures fell by 24 ticks, as traders responded to the lowered global production outlook, offset by the lack of significant changes in U.S. supply and demand.

Rice: Rising Imports and Stocks, Price Drops

The U.S. rice market saw increased supplies due to higher imports, with long-grain imports rising while medium- and short-grain imports declined. Domestic use hit a record 166.0 million cwt, while exports fell by 4.0 million cwt. Ending stocks climbed 18% year-over-year to 47.0 million cwt—the highest in a decade. The season-average farm price dropped by $0.20 per cwt to $15.40.

Globally, rice supplies dipped slightly due to a production decline in Sri Lanka, while consumption and trade increased. India’s exports were raised to a near-record 22.0 million tons. Ending stocks fell by 0.5 million tons, mainly due to reductions in India and Sri Lanka.

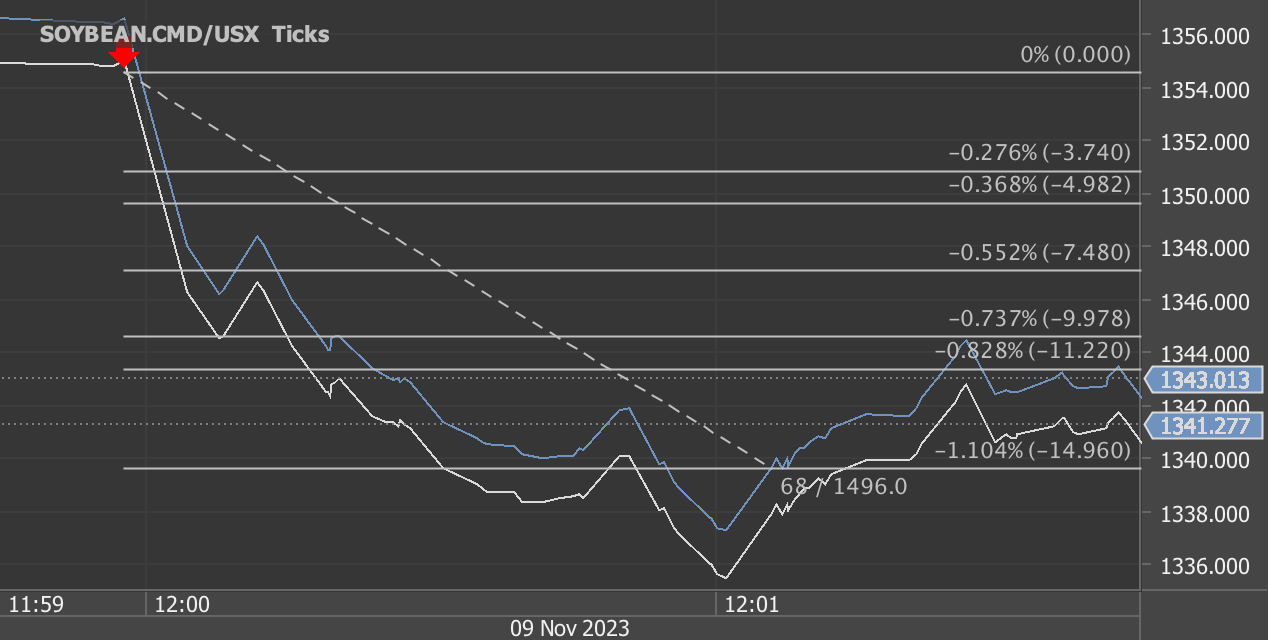

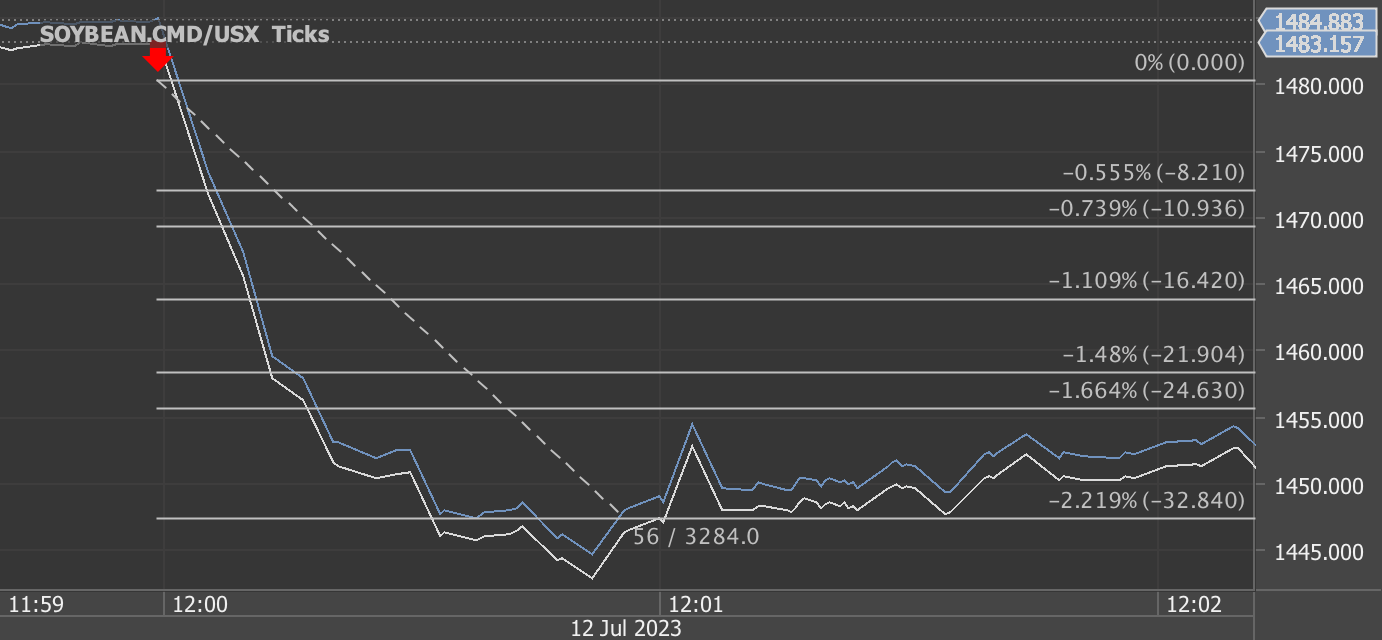

Soybeans: Lower Global Stocks, U.S. Price Down

While the U.S. soybean balance sheet remained unchanged, the season-average price dropped by 10 cents to $10.10 per bushel. Global soybean production fell, particularly in Argentina and Paraguay, due to persistent heat and dryness. Brazilian production remained at 169.0 million tons, with strong performance in the Center-West offsetting losses in the south. Global soybean ending stocks declined by 4.0 million tons, primarily due to reductions in Argentina and Brazil.

Livestock and Dairy: Production Adjustments and Price Revisions

Beef: Increased U.S. production expectations led to higher export forecasts, supported by strong global demand. Cattle prices rose across all quarters.

Pork: Production was raised, but exports were lowered due to slower demand in key markets.

Poultry: Broiler and turkey production faced downward revisions due to Highly Pathogenic Avian Influenza (HPAI)-related culling.

Eggs: Lower production forecasts due to HPAI-related flock reductions pushed prices higher.

Dairy: Lower milk production forecasts resulted in tighter domestic supplies, while the all-milk price forecast was revised slightly down to $22.60 per cwt.

Cotton: Minimal Adjustments, Lower Farm Price

The U.S. cotton balance sheet saw minor changes, with domestic mill use lowered and ending stocks increased. The season-average upland farm price was reduced to 63.5 cents per pound. Global cotton production rose, largely due to a 1-million-bale increase in China’s crop, while consumption and trade saw nominal changes.

Key Takeaways for Traders:

Bearish Corn & Wheat Futures: Declines of 24 and 16 ticks, respectively, indicate market responses to global production trends and stock adjustments.

Soybean Prices Under Pressure: Lower global stocks suggest tight supplies, but weaker price action indicates concerns over demand.

Rice & Sugar Trends: Higher rice stocks could keep prices under pressure, while sugar market adjustments reflect shifting trade flows.

Livestock & Dairy: Price movements across cattle, hogs, and dairy suggest volatility tied to supply constraints and trade dynamics.

Final Thoughts

This WASDE report highlights the importance of monitoring weather-driven production risks, shifting trade flows, and evolving demand trends. With notable changes in global stocks and trade, traders should stay alert to potential market shifts in the coming months.

For those in the agricultural markets, the February 2025 WASDE offers both opportunities and risks. Stay informed, manage your positions wisely, and watch for further developments in weather, policy changes, and global demand trends.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Always conduct thorough research and consider seeking advice from a financial professional before making any investment decisions.

Source: https://www.usda.gov/oce/commodity/wasde/wasde0225.pdf

Haawks G4A is one of the fastest machine-readable data feeds for USDA data. We are beating big names in the industry by seconds. Coverage includes monthly USDA WASDE (World Agricultural Supply and Demand Estimates), quarterly USDA Grain Stocks and yearly USDA Prospective Plantings and USDA Acreage.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.