According to our analysis USDJPY and EURUSD moved 14 pips, US30 moved 144 points and BTC 739 points on University Michigan Consumer Sentiment / Inflation Expectations data on 7 February 2025.

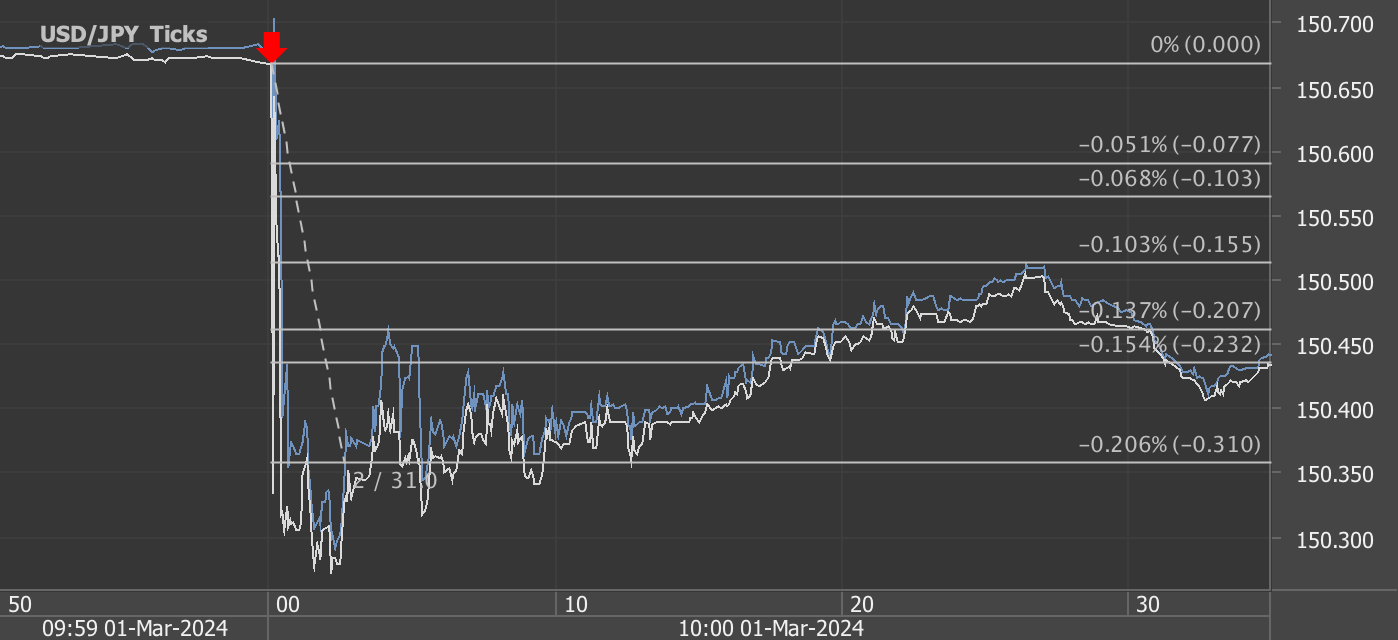

USDJPY (7 pips)

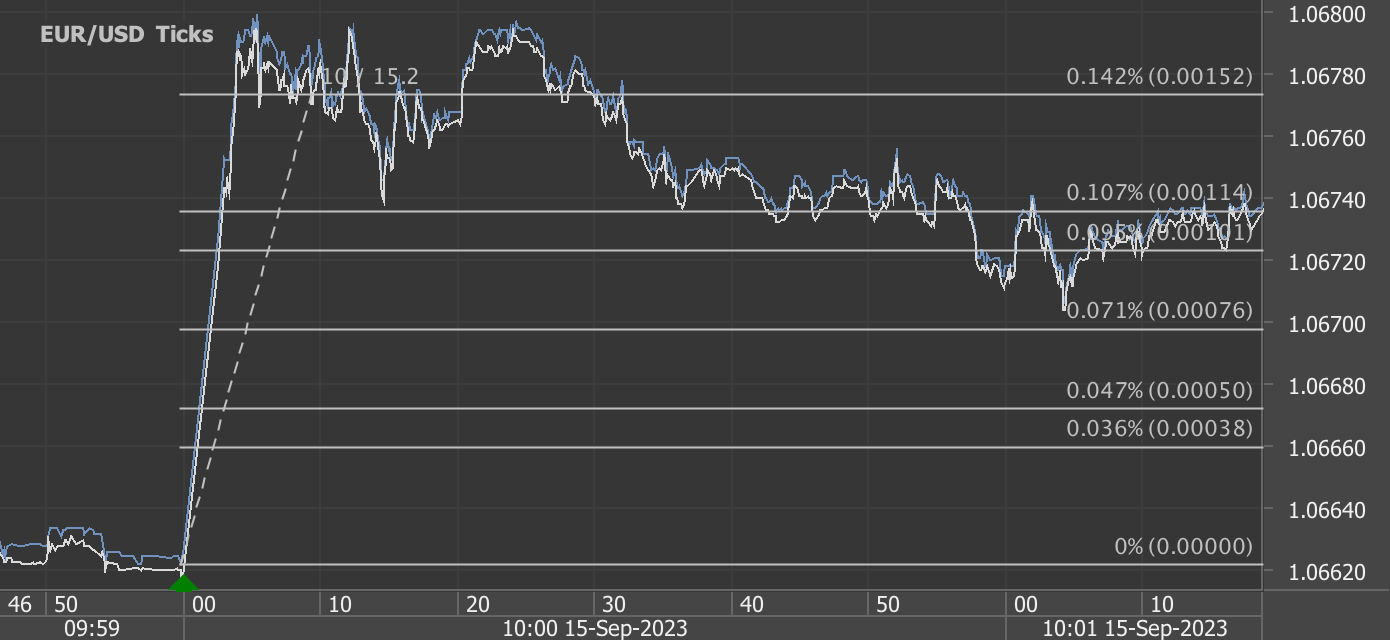

EURUSD (7 pips)

US30 (144 points)

BTC (739 points)

Charts are exported from JForex (Dukascopy).

Markets React to Consumer Sentiment Drop: US30 & BTC Decline

The preliminary consumer sentiment data for February 2025 came in lower than expected, triggering a broad risk-off sentiment across financial markets. The US30 (Dow Jones Industrial Average) and Bitcoin (BTC) both moved lower following the release, as traders reacted to rising inflation fears and weakening economic confidence.

Consumer Sentiment Declines for a Second Month

The Index of Consumer Sentiment fell to 67.8, marking a 4.6% decline from January and an 11.8% drop year-over-year. This drop represents the lowest level since July 2024 and reflects growing concerns over economic conditions, inflation, and future expectations.

The Current Economic Conditions index fell even further, down 7.2% month-over-month and 13.5% from last year, showing that consumers are increasingly cautious about spending. Meanwhile, the Index of Consumer Expectations declined 2.9% month-over-month and 10.5% year-over-year, signaling growing pessimism about the future economic landscape.

Market Reaction: US30 (Dow) Pulls Back

US equities, particularly the Dow Jones (US30), reacted negatively to the report. With consumer sentiment weakening, concerns over slowing economic growth and the impact of tariffs on durable goods purchases added downward pressure on stocks.

Buying conditions for durable goods fell by 12%, reinforcing concerns that consumer demand may weaken.

Inflation expectations jumped from 3.3% to 4.3%, raising fears that the Federal Reserve might have to keep interest rates higher for longer.

The market had been pricing in potential rate cuts later in the year, but rising inflation expectations complicate that outlook, leading to a sell-off in equities.

Bitcoin (BTC) Also Takes a Hit

Bitcoin, often seen as a hedge against inflation, has struggled to find bullish momentum in this environment. BTC dropped in tandem with equities, signaling that risk-off sentiment has spilled over into the crypto market.

Rising inflation concerns can sometimes benefit Bitcoin as a hedge, but if interest rates stay high for longer, it diminishes the appeal of speculative assets like BTC.

A decline in consumer sentiment and economic confidence could lead to reduced liquidity in financial markets, limiting Bitcoin’s upside in the short term.

Bitcoin has been trading in a tight range, and this sentiment-driven dip could push prices toward key support levels.

Looking Ahead: Key Levels to Watch

With final February consumer sentiment data set to be released on February 21, traders will be closely watching whether the trend worsens or stabilizes. Additionally, any new comments from the Federal Reserve on inflation expectations and interest rates will heavily influence market direction.

Conclusion: A Cautious Trading Environment

The sharp drop in consumer sentiment and rising inflation expectations have created uncertainty for both traditional and crypto markets. As traders assess the evolving macroeconomic landscape, volatility is likely to remain high. Risk management will be crucial in the coming weeks as markets digest incoming economic data and central bank policy signals.

For now, sentiment remains fragile, and traders should stay alert to any further deterioration in economic indicators that could fuel additional downside pressure in both US30 and BTC.

Source: http://www.sca.isr.umich.edu

Start futures and forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.