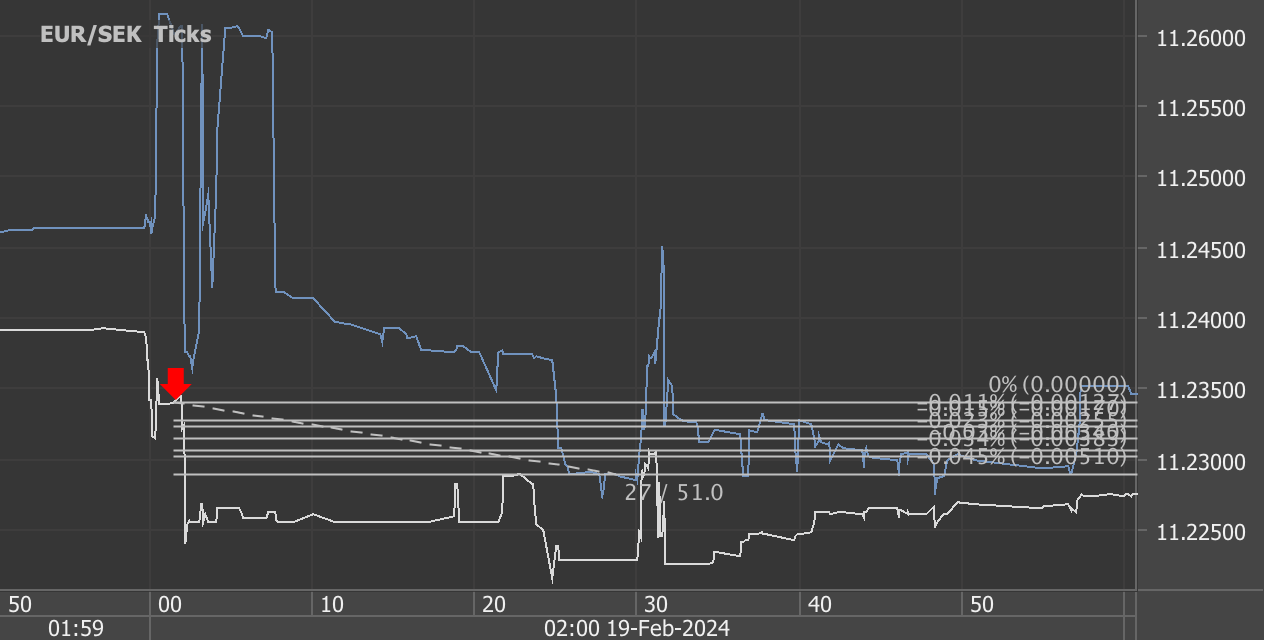

According to our analysis EURSEK moved 272 pips on Sweden Consumer Price Index (CPI) data on 12 July 2024.

EURSEK (272 pips)

Charts are exported from JForex (Dukascopy).

Understanding the Latest CPI Figures: A Deep Dive into Sweden's Inflation Trends as of June 2024

Inflation is a crucial economic indicator that affects everyone—from policymakers to the average consumer. The most recent data from Statistics Sweden provides us with a comprehensive look into the current state of inflation in Sweden as of June 2024, revealing a complex picture of the economy.

A Closer Look at June's CPI Figures

As of June 2024, the inflation rate according to the Consumer Price Index (CPI) stood at 2.6%, a noticeable decline from the 3.7% recorded in May. This marks the lowest inflation rate since September 2021, indicating a significant easing of price pressures. The decrease on a month-to-month basis was -0.1% from May to June, further highlighting this trend of deceleration in price increases.

The Consumer Price Index with a fixed interest rate (CPIF), another key measure, registered an inflation rate of just 1.3% for the same period, which differs from the CPI by excluding the direct effects of changes in interest rates.

Significant Factors Influencing the CPI

Several categories had notable impacts on the CPI figures for June:

Electricity and Fuel: There has been a year-long decrease in electricity and fuel prices, which has played a substantial role in moderating the overall inflation rate.

Housing and Interest Rates: Housing costs continued to rise, influenced heavily by increasing mortgage costs and higher fees for rented and tenant-owned apartments. This was partly offset by the declining electricity prices compared to last year.

Package Holidays: Prices for package holidays surged in June, showing a significant seasonal increase of 29.0% from May, contributing a 0.2 percentage point increase to the CPI.

Price Base Amount Adjustment

Looking ahead, the price base amount, which is a key reference for various forms of social benefits and taxes in Sweden, has been set at SEK 58,800 for 2025. This represents an increase of SEK 1,500 from the previous year, which will impact financial planning for both individuals and businesses.

New Developments in Inflation Measurement

An exciting development is the introduction of the "CPI flash estimate" by Statistics Sweden, set to begin this autumn. This new measure will provide preliminary inflation figures five working days before the regular publication, offering a quicker snapshot of economic trends.

Implications for Policy and Everyday Life

These inflation figures are more than just numbers; they have real-world implications for monetary policy, wage negotiations, and cost of living adjustments. Lower inflation may suggest less pressure on households in terms of rising costs, but it also poses challenges for policymakers in stimulating economic growth.

For consumers, understanding these trends helps in making informed decisions about savings, investments, and spending. For businesses, particularly those in sectors directly affected by these changes like energy, housing, and tourism, these trends can influence pricing strategies and financial planning.

Looking Forward

As we anticipate the next release on August 14, 2024, it will be interesting to see if these trends hold steady or if new factors will emerge that could lead to changes in the inflation landscape. Keeping an eye on these developments is crucial for anyone involved in economic planning and decision-making in Sweden.

In summary, while the decrease in inflation as of June 2024 provides a temporary relief, the diverse factors at play suggest a complex economic environment that requires careful monitoring and analysis.

Start futures forex fx news trading with Haawks G4A low latency machine-readable data today, one of the fastest news data feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.