According to our analysis USDJPY and EURUSD moved 17 pips on US Philadelphia Federal Reserve Bank Manufacturing Business Outlook Survey data on 16 May 2024.

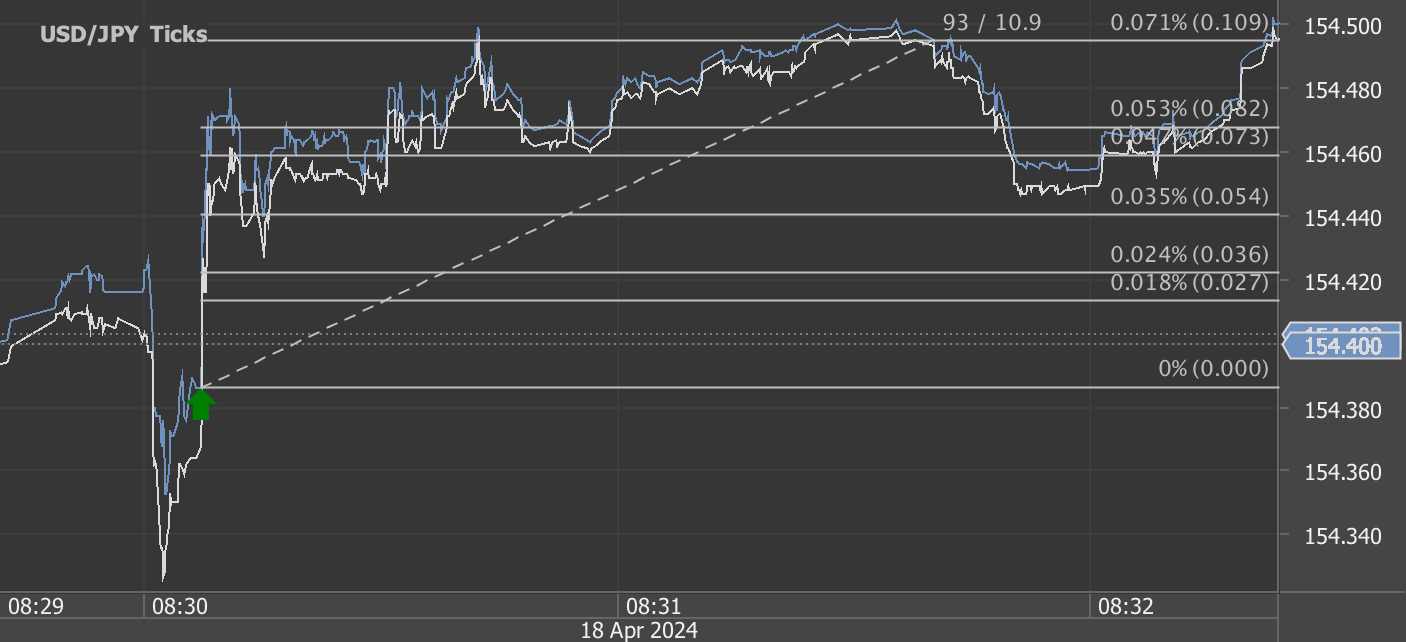

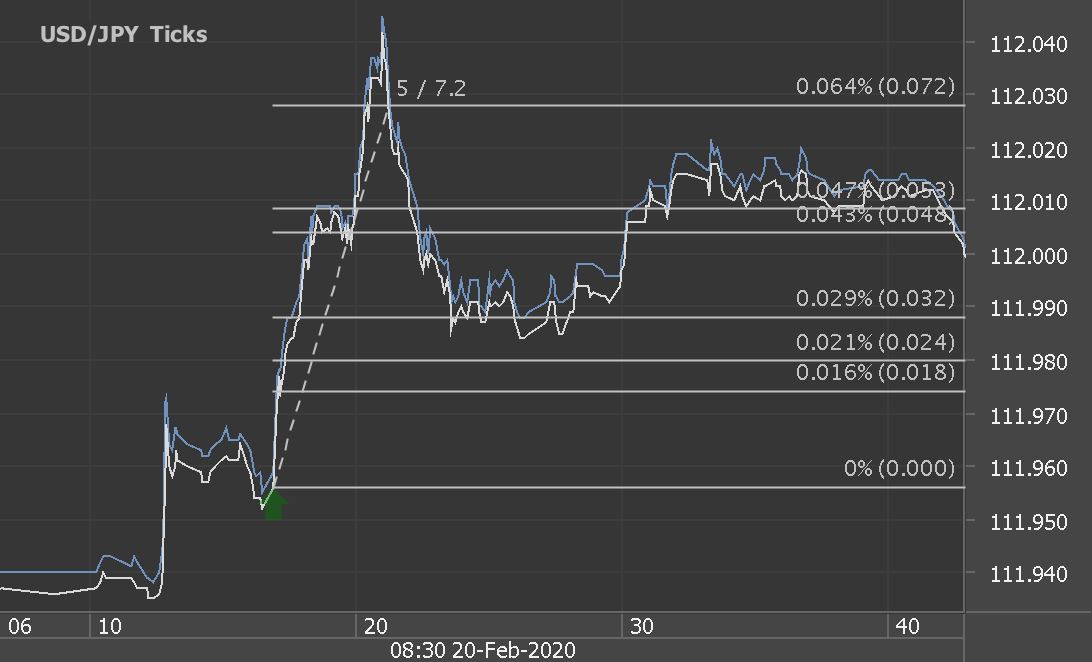

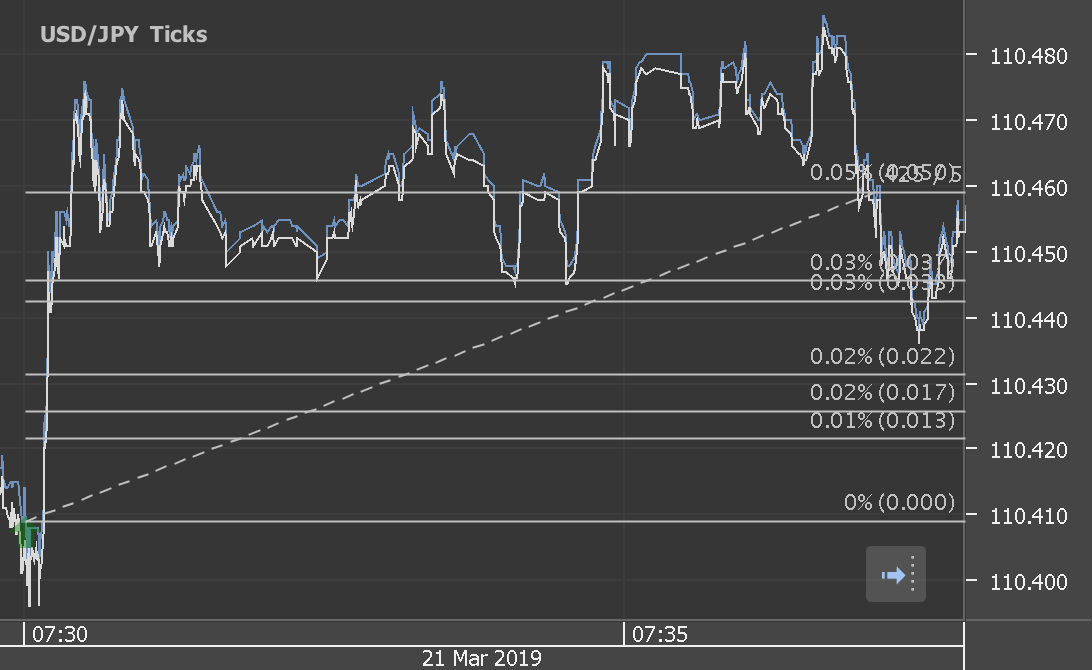

USDJPY (12 pips)

EURUSD (5 pips)

Charts are exported from JForex (Dukascopy).

May 2024 Manufacturing Business Outlook: A Mix of Decline and Optimism

The results from the May 2024 Manufacturing Business Outlook Survey indicate a mixed bag for the regional manufacturing sector, presenting a scenario where current conditions have softened, yet future prospects remain positive. Conducted between May 6 and May 13, the survey captures the opinions of regional manufacturing firms, revealing a slight weakening in present activities but a sustained expectation of growth in the months ahead.

Current Manufacturing Climate: Challenges on Multiple Fronts

The survey underscores a noticeable decline in several key indicators this month. The diffusion index for current general activity, while still positive, has dropped 11 points to 4.5, primarily reversing the gains observed last month. This downward trend is also reflected in the new orders and shipments indexes, both of which have dipped into negative territory for the first time since early this year; new orders fell from 12.2 to -7.9, and shipments dropped from 19.1 to -1.2.

In terms of employment, the indicators are somewhat conflicting. Although the employment index itself showed a slight improvement, rising 3 points to -7.9, the overall balance still points to a decline in employment. A significant portion of firms (20%) reported a decrease in employment levels, overshadowing the 12% that noted an increase.

Pricing Trends: Increases Continue but Below Long-Term Averages

Price pressures continue to be a notable concern, albeit remaining below historical averages. The prices paid index decreased slightly by 4 points to 18.7, indicating ongoing rises in input costs. Conversely, the prices received index for firms’ own goods nudged up by just 1 point to 6.6, suggesting a more moderate pass-through of costs to consumers.

Future Outlook: Optimism Prevails Despite Current Downturn

Despite the current downturn, the survey reveals an overarching sense of optimism among firms about the future. The future general activity index experienced a minor decline but remained robust at 32.4, suggesting that a significant number of firms (45%) expect increases in activity over the next six months. This sentiment is bolstered by positive movements in the indexes for future new orders and shipments, with particularly strong expectations for the latter, which climbed 17 points to 46.2.

Employment prospects also appear more hopeful, as reflected by the 9-point rise in the future employment index to 21.7. This signals that firms are generally anticipating the need for more hands on deck as business activities are expected to ramp up.

Special Focus: Inflation Expectations and Price Forecasts

This month’s survey included special questions about price forecasts, revealing that firms expect a steady rise in their own prices by about 3.0% over the next year, mirroring the expected rate of inflation for U.S. consumers. While these projections hold steady from previous forecasts, there’s a slight downtrend in the expected rise in employee compensation, suggesting cautious optimism about cost management.

Conclusion

The May Manufacturing Business Outlook Survey paints a realistic picture of the current manufacturing landscape—while immediate conditions show signs of softening, particularly in new orders and shipments, the broader outlook remains positive. This resilience amidst challenges highlights the sector's adaptability and forward-looking nature, suggesting that firms are poised to navigate through current uncertainties with a focus on future growth opportunities.

Source: https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/mbos-2024-05

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.