According to our analysis USDJPY and EURUSD moved 16 pips on US Gross Domestic Product (GDP) data on 30 October 2024.

USDJPY (12 pips)

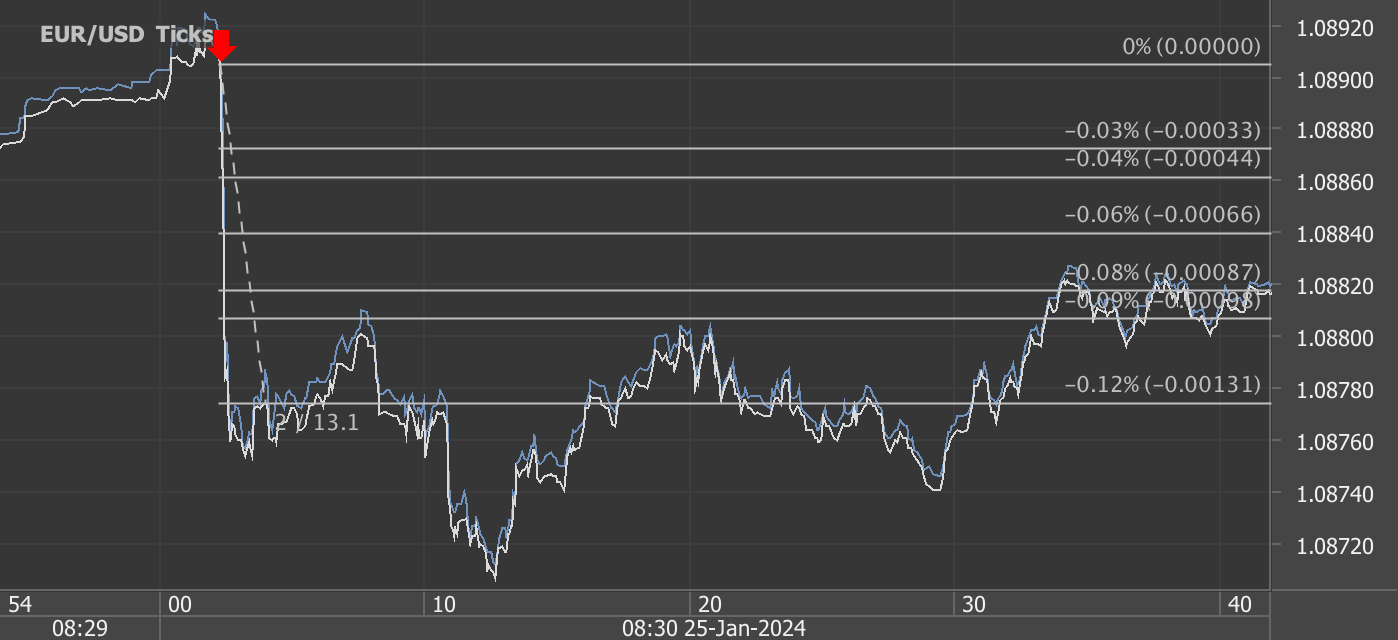

EURUSD (4 pips)

Charts are exported from JForex (Dukascopy).

Understanding the U.S. Economy: A Look at Q3 2024's GDP Performance

The U.S. Bureau of Economic Analysis (BEA) has just released its “advance” estimate for the Gross Domestic Product (GDP) for the third quarter of 2024, and there’s plenty to unpack. This preliminary figure provides valuable insight into the economic health of the country, although it’s essential to note that these numbers can be revised as more complete data becomes available.

Key Takeaways from Q3 2024 GDP Data

Real GDP in the U.S. grew at an annual rate of 2.8% in the third quarter of 2024. While this reflects steady growth, it’s a slight deceleration from the 3.0% increase seen in the second quarter. This slowing momentum was primarily attributed to a downturn in private inventory investment and a larger decrease in residential fixed investment. However, bright spots included boosts in consumer spending, exports, and federal government spending.

Breaking Down the Numbers

Consumer Spending: This remained a significant driver of GDP growth, with contributions from both goods and services. Within the goods category, notable increases were seen in non-durable goods, particularly prescription drugs, and motor vehicles and parts. The services sector saw gains primarily in health care—specifically outpatient services—and food services and accommodations.

Exports: The surge in exports was led by capital goods, excluding automotive products, signaling robust demand for U.S. products overseas.

Federal Government Spending: An increase in defense spending helped bolster overall federal spending, contributing positively to the GDP figure.

Imports: It’s worth noting that imports also increased during this period, and since imports are subtracted in the GDP calculation, this rise partly offset the other gains.

What’s Behind the Deceleration?

While consumer spending and exports gained traction, the third quarter saw a notable reduction in private inventory investment. This suggests that businesses might be treading cautiously, perhaps in response to economic uncertainties or inventory management strategies. Additionally, the decrease in residential fixed investment indicates continued challenges in the housing market, which has been a trend in recent quarters.

Current-Dollar GDP and Price Indices

In terms of current-dollar GDP, the economy expanded by 4.7%, translating to an increase of $333.2 billion, bringing the total to $29.35 trillion. This was a step down from the 5.6% growth recorded in the second quarter.

Inflationary pressures showed signs of easing in Q3. The price index for gross domestic purchases increased by just 1.8%, down from 2.4% in the previous quarter. The Personal Consumption Expenditures (PCE) price index, a key measure for consumer prices, rose by 1.5%, a significant drop from the 2.5% in Q2. When food and energy were excluded, the PCE price index marked a 2.2% increase, compared to 2.8% in Q2.

Personal Income and Savings

Personal income continued to grow but at a slower pace, increasing by $221.3 billion in Q3 compared to $315.7 billion in Q2. The rise was largely driven by higher compensation. Real disposable personal income, adjusted for inflation, increased by 1.6% following a 2.4% rise in the previous quarter.

The personal saving rate—a gauge of how much income households are saving—dropped to 4.8%, down from 5.2% in Q2. This decline could indicate that consumers are tapping into their savings more to sustain spending in the face of income pressures or shifting economic conditions.

What’s Next?

The “second” estimate for Q3 2024, which will include more comprehensive data, is set for release on November 27, 2024. This revision will offer a clearer picture of economic trends and potential adjustments to today’s figures. Alongside it, the BEA will release a preliminary estimate for corporate profits, adding more context to the overall economic landscape.

Final Thoughts

The U.S. economy showed solid yet slightly moderated growth in Q3 2024, signaling resilience despite facing various headwinds. Consumers continued to spend, the federal government increased its investments, and exports remained robust, showcasing strength in multiple sectors. However, cautionary trends, such as the dip in private inventory investment and the slowdown in income growth, suggest that businesses and consumers are navigating an uncertain economic climate. The coming months and further data will provide deeper insights into whether this moderation is temporary or indicative of a broader economic trend.

Stay tuned for the BEA’s next release on November 27 for a more refined view of the third quarter and a look at corporate profit trends.

Source: https://www.bea.gov/news/2024/gross-domestic-product-third-quarter-2024-advance-estimate

Start futures forex fx news trading with Haawks G4A low latency machine-readable data, one of the fastest machine-readable news trading feeds for macro-economic and commodity data from the US and Europe.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.