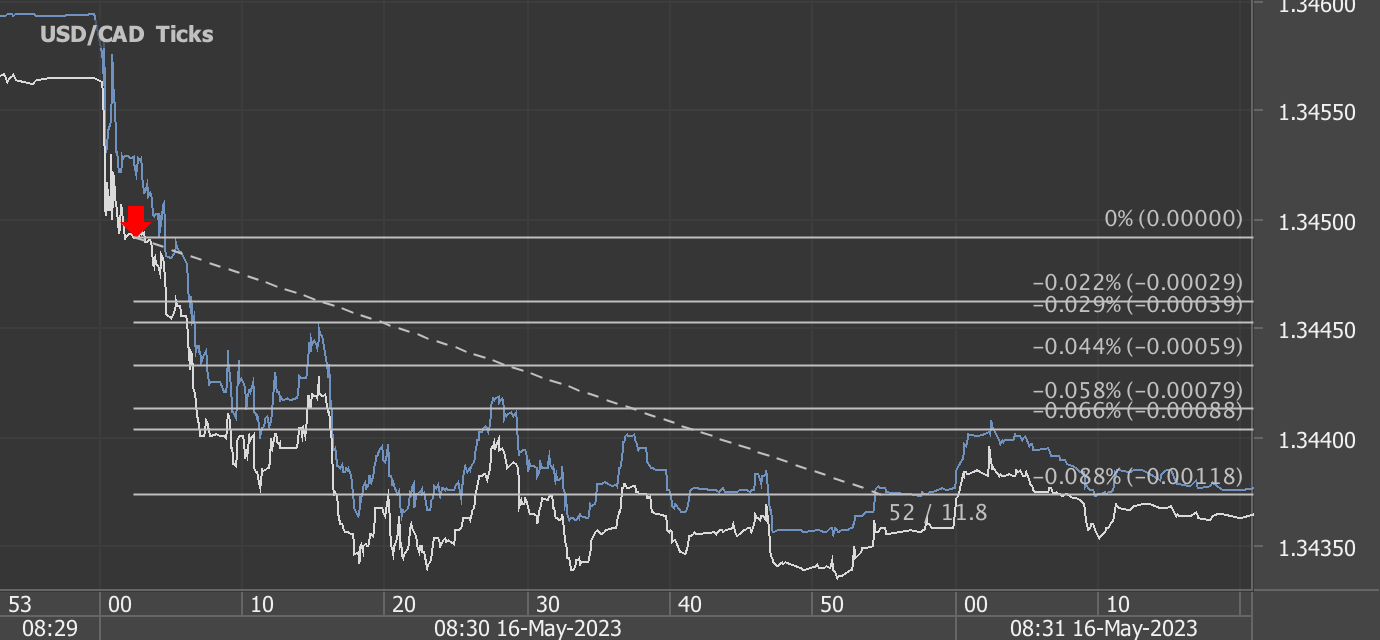

According to our analysis USDCAD moved 20 pips on Canada Gross Domestic Product (GDP) data on 30 April 2024.

USDCAD (20 pips)

Charts are exported from JForex (Dukascopy).

Analyzing the Nuances of Canada's GDP Growth in February 2024

In February 2024, Canada's real Gross Domestic Product (GDP) witnessed a modest increase of 0.2%, maintaining a stable yet slower growth compared to the 0.5% rise observed in January. This growth was primarily driven by the services-producing industries, with notable performances in transportation and warehousing sectors.

Sectoral Highlights of February's GDP Growth

Transportation and Warehousing Take the Lead

The transportation and warehousing sector showcased a significant growth of 1.4%, marking the largest monthly growth rate since January 2023. A notable rebound in rail transportation, which surged by 5.5%, played a critical role in this expansion. The uplift in rail activities came as operations normalized following the harsh weather conditions in Western Canada earlier in the year. Additionally, air transportation also saw a substantial increase of 4.8%, fueled by a rise in international travel, particularly to Asia around the Lunar New Year.

Utilities and Manufacturing Face Downturns

Contrasting the gains in transportation and warehousing, the utilities sector experienced a decline of 2.6%. This downturn is partly attributed to a decrease in demand for heating following a particularly cold January. Similarly, the manufacturing sector faced challenges, declining by 0.4%, with significant setbacks in transportation equipment manufacturing due to ongoing retooling shutdowns.

Mining and Oil & Gas Sectors Bounce Back

The mining, quarrying, and oil and gas extraction sector witnessed a growth of 2.5%, effectively recuperating from a 2.3% drop in January. This recovery was led by a 3.3% increase in oil and gas extraction, excluding oil sands, which saw growth across various production types. This sector's rebound underscores its volatile nature and susceptibility to external conditions, such as weather impacts on operational capabilities.

Public Sector and Financial Services Show Steady Growth

The public sector continued to grow, although at a slower pace of 0.2%, with educational services and healthcare contributing modestly. Meanwhile, the finance and insurance sector recorded a 0.3% increase, marking its third consecutive month of growth, driven by robust activities in financial investment services.

Looking Forward: Preliminary Estimates for March 2024

Preliminary data for March 2024 suggests that the real GDP remained largely unchanged, with gains in utilities and real estate being offset by declines in manufacturing and retail trade. This points to a mixed economic landscape where certain sectors are expanding while others retract, reflecting the complex interplay of domestic and global economic factors.

Conclusion

As we await the official first-quarter GDP figures due for release on May 31, 2024, it's clear that Canada's economy is experiencing a period of cautious optimism mixed with sector-specific challenges. The ongoing fluctuations across different industries highlight the need for businesses and policymakers to remain adaptable and responsive to changing economic conditions. This nuanced picture of Canada's economic health offers valuable insights into the resilience and vulnerabilities within its diverse sectors.

Source: https://www150.statcan.gc.ca/n1/daily-quotidien/240430/dq240430a-eng.htm

Start futures forex fx news trading with Haawks G4A low latency machine-readable data today, one of the fastest news data feeds for US macro-economic and commodity data.

Please let us know your feedback. If you are interested in timestamps, please send us an email to sales@haawks.com.